Summary of Reimbursable and Non-Reimbursable Expenses for Travel

A list of expenses and receipt requirements are indicated in the table below. NOTE: This is not an inclusive list of all expenses. Check with your accountant for questions.

Expense | Reimbursable? | Receipt needed if paid with personal funds? | Receipt needed if charged to P-card? | Comments |

Airfare and Rail | Yes (limited to coach class only) | Yes | Yes | Provide one of the following:

|

Lodging | Yes | Yes | Yes | Provide Concur E-receipt (if enabled), or the original itemized paid receipt. |

Rental Cars | Yes | Yes | Yes | Provide Concur E-receipt (if enabled), or the original itemized car rental receipt showing the dates and location of rental, detailed cost, and amount paid. Rental cars may only be used if they represent the most cost efficient means of transportation. Justification and prior approval is required.

|

Collision Insurance or Loss/Damage Waiver on Rental Cars (Domestic) | N/A | N/A | N/A | The University self-insures for commercial rental vehicle loss/damage for continental US – (CONUS) or Canadian travel. Risk Management advises that travelers decline rental car Collision Insurance or Loss/Damage Waiver during domestic travel. |

Collision Insurance or Loss/Damage Waiver on Rental Cars (International) | Yes | Yes, as included in itemized rental car receipt | Yes, as included in itemized rental car receipt | Collision Insurance or Loss/Damage Waiver is recommended when traveling to destinations outside the continental US. |

Gas for Rental Cars | Yes | Yes | Yes | Provide the original itemized paid receipt (no minimum amount). Note: Please refuel the car before returning it to avoid high refueling charges to the University. |

Conference Registration | Yes | Yes | Yes | Provide the original itemized paid receipt. |

Taxi/Local Ground Transportation | Yes, if not in conjunction with a travel meal | Yes | Yes | Provide the original itemized paid receipt.

Ground transportation to a meeting place, lodging, or airport is reimbursable. Ground transportation to a meal paid through per diem is included in per diem. |

Parking

| Yes | Yes | Yes | Provide the original itemized paid receipt. |

Tolls | Yes | Yes | Yes |

Provide the original itemized paid receipt.

|

Mileage | Yes | N/A | N/A | Not to exceed the cost of coach airfare. Reimbursable from Ann Arbor to destination (i.e. airport) Under 20 mile radius is considered local travel and is not reimbursable. |

Internet Fees

| Yes | Yes | Yes | Provide the original itemized paid receipt. |

Inoculation Costs | Yes | Yes | Yes |

Provide the original itemized paid receipt.

|

Currency Conversion Fees | Yes | Yes | Yes | Provide the original itemized paid receipt. |

Travel Abroad Health Insurance | Yes | Yes | Yes | Active U-M students, faculty, staff, and dependents are eligible to purchase optional coverage for international travel. In some cases, travelers may be required to purchase this plan. Read more about the plan at http://www.uhs.umich.edu/tai/ or contact your department for further details.

|

Travel Accident Insurance | N/A | N/A | N/A | Travel accident insurance is included as part of benefits program for all University employees on travel status. Contact the Benefits Office for more information. |

Expense | Reimbursable? | Receipt needed if paid with personal funds? | Receipt needed if charged to P-card? | Comments |

Business Office Expenses (Postage, Copy Services, etc.) | Yes | Yes | Yes | Provide the original itemized paid receipt. |

Laundry or Cleaning Expenses | Yes, if the trip is 7 days or longer | Yes | Yes | Provide the original itemized paid receipt. |

Checked Luggage | Yes | Yes | Yes | The University will reimburse for a maximum of two (2) pieces of checked luggage. |

Excess Baggage or Excess Weight | At unit’s discretion |

|

| This is an exception that requires the submission of a signed exception memorandum approved by the Vice President, Dean, or Chair explaining why an exception is warranted. A compelling University business purpose is required for approval. |

Traveler’s Check Charge | At unit’s discretion |

|

| This is an exception that requires the submission of a signed exception memorandum approved by the Vice President, Dean, or Chair explaining why an exception is warranted. A compelling University business purpose is required for approval. |

Travel Meal Expenses

Each travel meal type is listed below and indicates if a traveler is a) reimbursed at the actual meal cost, or b) provided a fixed meal allowance (per diem).

Meal Type | Provided a Fixed Allowance? / Reimbursed for Actual Meal Costs? | Receipt needed if paid with personal funds? | Receipt needed if charged to P-card? | Comments |

Employee – (Domestic/CONUS Per Diem Meal) | Fixed Allowance | No | No | Employees on travel status will be provided a per diem rate for travel meals for domestic (continental US/CONUS) travel. (See the General Services Administration website www.gsa.gov for meal per diem amounts listed by specific major cities). |

Employee – (Foreign/OCONUS Per Diem Meal)* | Fixed Allowance | No | No | *Effective July 15, 2010, employees on travel status will be provided a per diem rate for travel meals for foreign/OCONUS travel. (See the General Services Administration website www.gsa.gov for meal per diem amounts listed by specific major cities). |

Non-Employee – (Guest and Student) Meal | Actual Cost | No | No | Guest and student travel meals are reimbursed at the actual amount up to the meal limits of $25-Breakfast, $25-Lunch, $55-Dinner (including tax, tip, and non-alcoholic beverages). Please have all receipts for reimbursement. |

Business Meal While on Travel Status | Actual Cost | Yes | Yes | Business meals are those taken with guests, colleagues, or donors during which focused business discussions take place. Business meals with vague, unfocused purposes (such as “to foster collaboration between departments”) are not permitted.

Business meal expenses, including beverages and tips, should not exceed the maximum allowance of $25-Breakfast, $25-Lunch, $55-Dinner per person.

University faculty and staff who host or attend a hosted meal while on “travel status” must indicate the hosted meal was ‘provided’ when completing the travel allowance (per diem) portion of the expense report. |

Hosted Meal While on Travel Status | Actual Cost | Yes | Yes | Hosted meal expenses, including beverages and tips, should not exceed the maximum allowance of $25-Breakfast, $25-Lunch, $55-Dinner per person.

University faculty and staff who host or attend a hosted meal while on “travel status” must indicate the hosted meal was ‘provided’ when completing the travel allowance (per diem) portion of the expense report. |

Alcohol | Actual Cost | Yes | Yes | Reimbursement for alcoholic beverages is limited to $20/person, per hosted event. Alcohol cannot be expensed to general or sponsored funds and must be expensed as ICRX class. |

FACULTY TRAVEL:

Faculty Travel Form: http://www.pathology.med.umich.edu/forms/Faculty%20Travel%20Form.pdf

All Faculty Travel Reimbursement Forms should be turned in to the Chairman's Office Front Desk.

STAFF TRAVEL:

All Staff Travel Reimbursement Forms must show prior authorization for travel or be signed by your supervisor.

Please turn your form and receipts to John Harris, who will distribute to the proper person.

Staff Travel Form: http://www.pathology.med.umich.edu/forms/Staff%20Travel%20Form.pdf

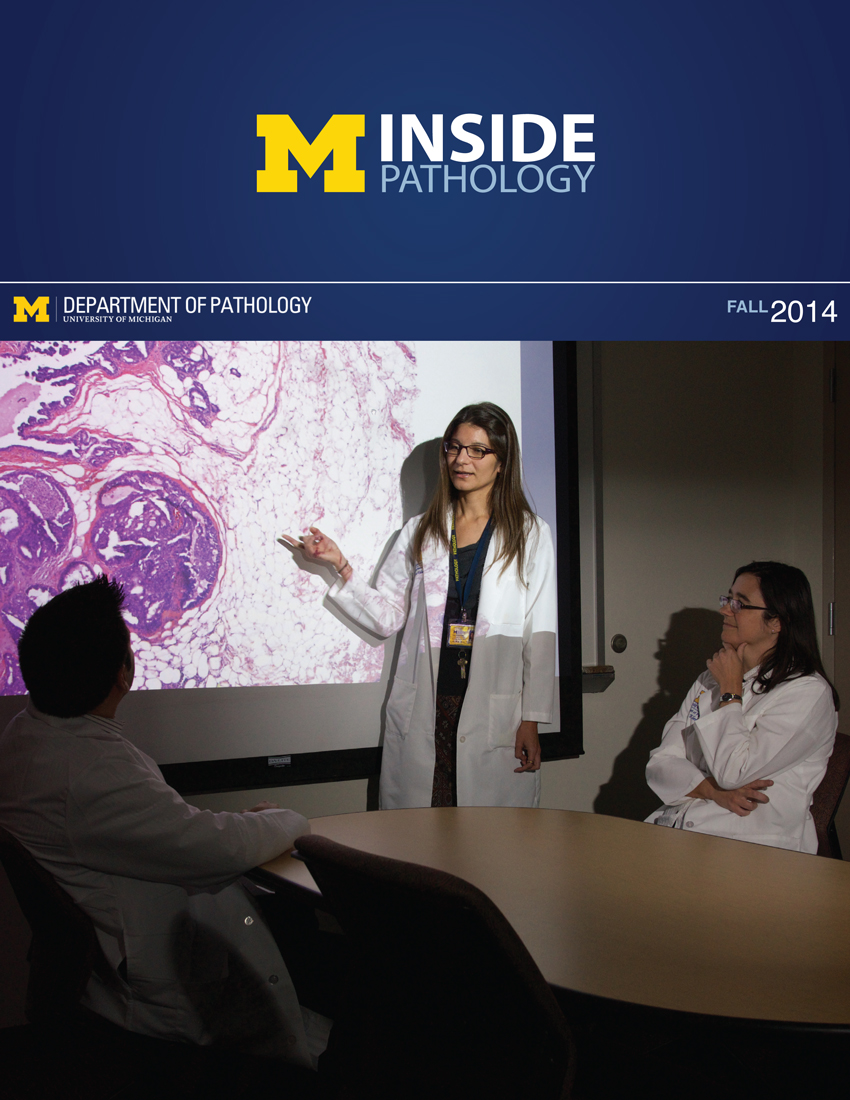

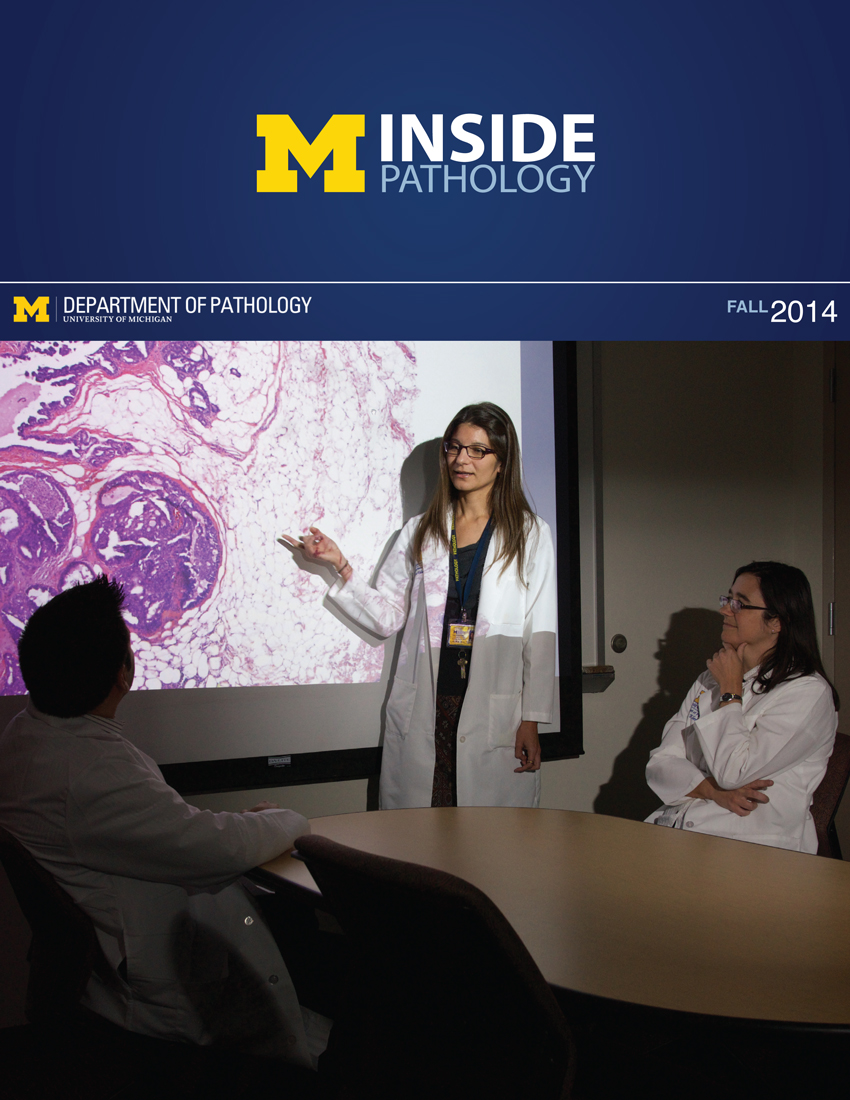

ON THE COVER

ON THE COVER

Breast team reviewing a patient's slide. (From left to right) Ghassan Allo, Fellow; Laura Walters, Clinical Lecturer; Celina Kleer, Professor. See Article 2014Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Autopsy Technician draws blood while working in the Wayne County morgue. See Article 2016Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Dr. Sriram Venneti, MD, PhD and Postdoctoral Fellow, Chan Chung, PhD investigate pediatric brain cancer. See Article 2017Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Director of the Neuropathology Fellowship, Dr. Sandra Camelo-Piragua serves on the Patient and Family Advisory Council. 2018Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Residents Ashley Bradt (left) and William Perry work at a multi-headed scope in our new facility. 2019Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Dr. Kristine Konopka (right) instructing residents while using a multi-headed microscope. 2020Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Patient specimens poised for COVID-19 PCR testing. 2021Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Dr. Pantanowitz demonstrates using machine learning in analyzing slides. 2022Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

(Left to Right) Drs. Angela Wu, Laura Lamps, and Maria Westerhoff. 2023Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Illustration representing the various machines and processing used within our labs. 2024Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

ON THE COVER

ON THE COVER

Rendering of the D. Dan and Betty Khn Health Care Pavilion. Credit: HOK 2025Department Chair |

newsletter

INSIDE PATHOLOGYAbout Our NewsletterInside Pathology is an newsletter published by the Chairman's Office to bring news and updates from inside the department's research and to become familiar with those leading it. It is our hope that those who read it will enjoy hearing about those new and familiar, and perhaps help in furthering our research. CONTENTS

|

MLabs, established in 1985, functions as a portal to provide pathologists, hospitals. and other reference laboratories access to the faculty, staff and laboratories of the University of Michigan Health System’s Department of Pathology. MLabs is a recognized leader for advanced molecular diagnostic testing, helpful consultants and exceptional customer service.